Introduction

In today’s fast-paced world, the financial industry is at the forefront of digital transformation. This transformation is not just a trend but a necessity driven by consumer demand for instant, secure, personalized services. As a result, executives in the financial sector find themselves in a constant whirlwind of tasks and responsibilities that demand immediate attention. From cybersecurity threats to regulatory changes and from customer engagement to product innovation, the list is endless and ever-changing.

In this high-stakes environment, effective time management becomes not just a skill but a critical strategic asset. Enter the Eisenhower Matrix, a time-management tool that has stood the test of time, quite literally. Named after Dwight D. Eisenhower, the 34th President of the United States, this tool offers a simple yet powerful framework for prioritizing tasks based on their urgency and importance.

But how relevant is a tool inspired by a mid-20th-century President in the age of AI, blockchain, and fintech innovations? Surprisingly, very. This article aims to explore the Eisenhower Matrix’s applicability and effectiveness in the modern financial industry. We will delve deep into its mechanics, its strategic advantages, and its potential to drive both organizational and personal success. To provide a well-rounded perspective, this discussion will be enriched with real-world case studies and insights from industry experts.

What is the Eisenhower Matrix?

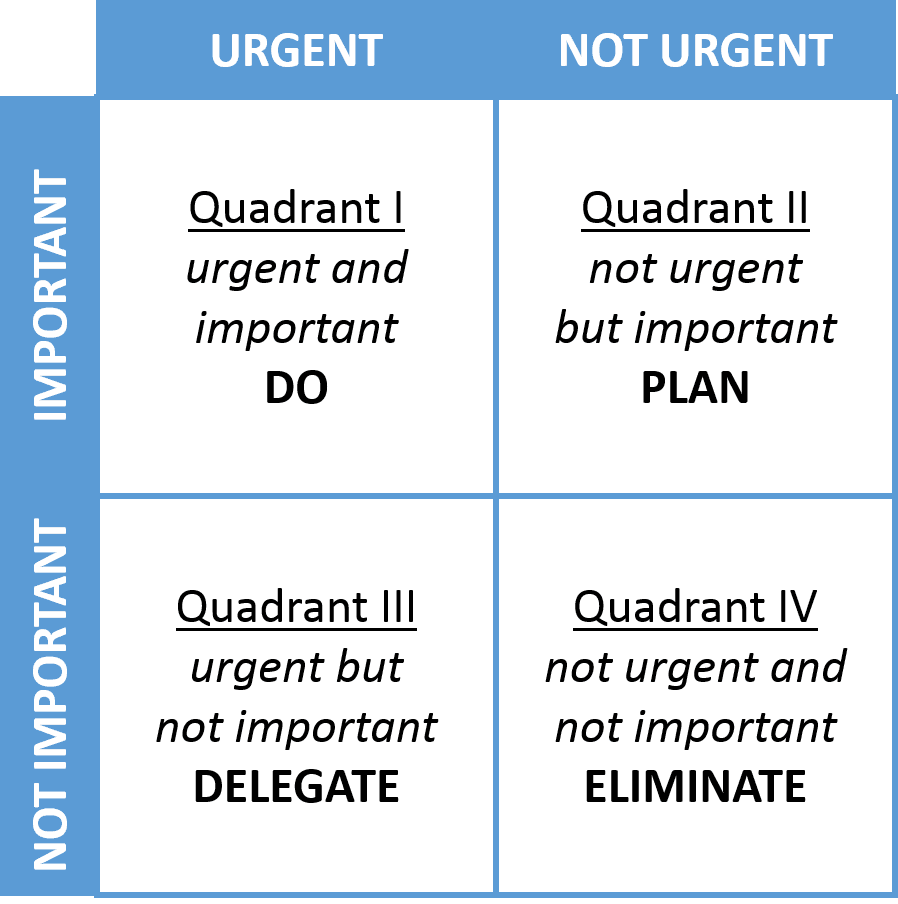

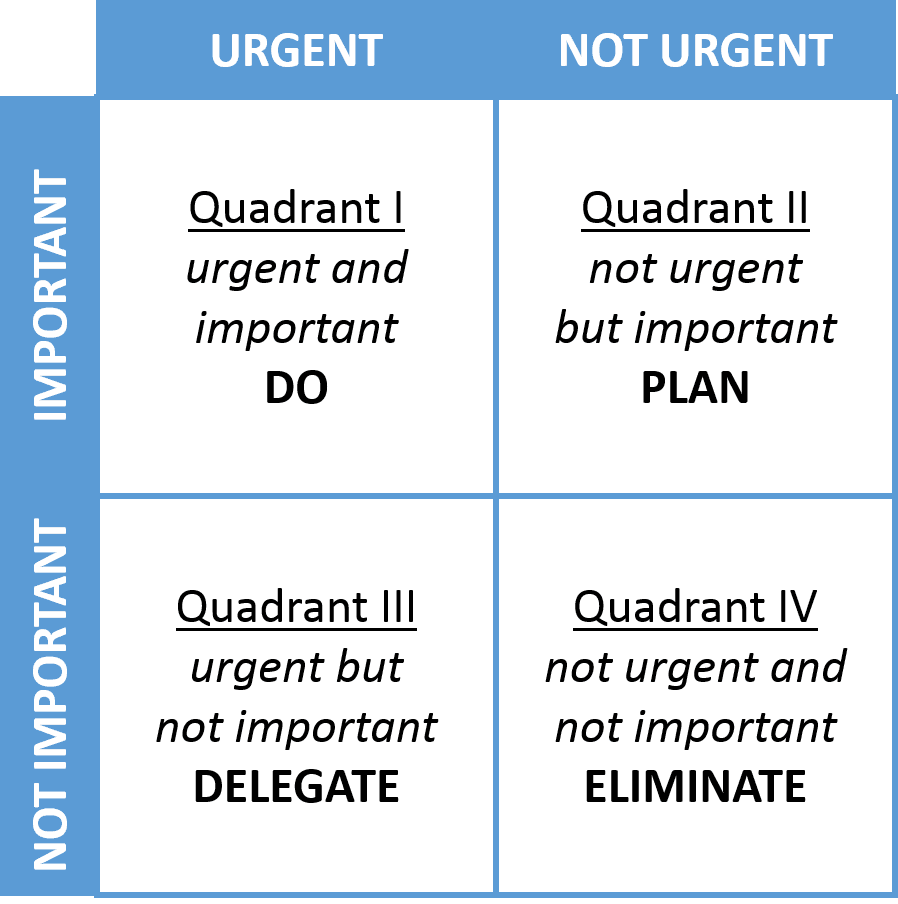

This principle was later adapted into a 2×2 grid, known as the Eisenhower Matrix, which serves as a graphical tool to help prioritize tasks based on two key parameters: importance and urgency. Here’s how it works:

- Important but Not Urgent: These are the tasks that contribute to long-term goals and mission-critical objectives. In the financial industry, this could include strategic planning, research and development, and employee training. While these tasks are essential for sustainable growth, they don’t require immediate action and can be scheduled for a later date.

- Important and Urgent: These tasks demand immediate attention and are usually associated with meeting deadlines, solving crises, or complying with regulatory changes. Failure to address these tasks promptly could result in significant consequences.

- Not Important but Urgent: These are the tasks that often come up unexpectedly and divert attention from more important activities. They should be either delegated or managed efficiently to minimize time spent. In a financial context, this could include responding to non-critical emails or handling minor customer complaints.

- Not Important and Not Urgent: These tasks offer little to no value and are often time-consuming. They should be eliminated from your to-do list. In the financial world, this could mean discontinuing obsolete services or products that no longer align with the company’s strategic goals.

For a more in-depth understanding, you can refer to this Corporate Finance Institute article, which provides a detailed breakdown of the Eisenhower Matrix and its applications.

Why is it Relevant in the Financial Industry?

In today’s fast-paced financial landscape, characterized by disruptive technologies and ever-changing regulations, the need for effective time management is paramount. The Eisenhower Matrix gains particular relevance in this context, offering a structured approach to decision-making that is crucial for executives and managers alike.

The financial industry is not just about numbers; it’s about making strategic choices under pressure. Whether you’re contemplating a high-stakes merger, navigating the complexities of global financial markets, or spearheading a digital transformation initiative, the Eisenhower Matrix can serve as a guiding framework. It helps you separate the ‘signal’ from the ‘noise,’ allowing you to focus on tasks that align with your organization’s strategic objectives.

A study conducted by Meng Zhu, Yang Yang, and Christopher Hsee at the University of Chicago Booth School of Business highlighted a common pitfall: people often prioritize tasks based on their perceived urgency rather than their actual importance. This is particularly detrimental in the financial sector, where poor prioritization can lead to missed opportunities, regulatory fines, or even reputational damage. The Eisenhower Matrix helps mitigate this tendency by forcing you to categorize tasks in a way that brings clarity to what truly matters.

Moreover, the matrix is not just a tool for individual productivity; it can be scaled to an organizational level. For instance, it can be integrated into project management software or used in team meetings to collectively decide on priorities. This ensures that everyone, from top-level executives to entry-level analysts, is aligned in their focus and efforts.

In summary, the Eisenhower Matrix is not just a time-management tool; it’s a strategic asset for the financial industry. Its ability to help prioritize tasks effectively makes it indispensable in a sector where the stakes are high, and the margin for error is low.

Who can define for us with accuracy the difference between the long and short term! Especially when our affairs seem to be in crisis, we are almost compelled to give our first attention to the urgent present rather than to the important future.

(Dwight D. Eisenhower in his 1961 address to the Century Association)

The Psychology of Decision-Making in Finance

The financial industry is a high-stakes arena where decisions can have far-reaching implications, not just for companies but also for economies at large. These decisions are often fraught with complexity, influenced by a myriad of factors such as volatile market conditions, ever-changing regulatory frameworks, and unpredictable customer behaviour. In such an environment, the psychology of decision-making becomes a critical element that can make or break an executive’s career.

Furthermore, the matrix encourages a separation of emotional impulses from logical analysis. In the financial industry, where decisions can be swayed by market sentiments or the fear of missing out (FOMO), this is invaluable. By categorizing tasks based on their actual importance and urgency, the matrix helps you to step back and assess situations from a rational standpoint. This is particularly crucial in high-pressure scenarios such as trading floors, risk assessments, or compliance checks.

The Eisenhower Matrix also aligns well with behavioural economics principles, which have gained significant traction in the financial sector. Behavioural economics, a field that combines insights from psychology and economics, has shown that humans are not always rational actors, especially under stress. The matrix serves as a tool to mitigate some of these behavioural pitfalls by providing a structured approach to decision-making.

In essence, the Eisenhower Matrix does more than just help you manage your time; it helps you manage your mind. Offering a psychological framework for decision-making, it equips financial executives with the mental tools needed to make more rational and effective choices in a complex and often unpredictable industry.

Case Study: Prioritizing in a Fintech Startup with the Eisenhower Matrix

In the fast-paced world of fintech startups, CEOs often find themselves overwhelmed with tasks that range from urgent software bugs to long-term strategic planning for funding rounds. One such example is a fintech startup that developed a cutting-edge trading platform. The CEO, let’s call him John, was struggling to manage his time effectively. He decided to employ the Eisenhower Matrix to prioritize his tasks and found it to be an invaluable tool for decision-making.

The Scenario

John had a multitude of tasks on his plate:

- Addressing immediate bugs in the trading platform

- Strategic planning for the next funding round

- Responding to non-urgent emails and meeting requests

- Social media updates

The Application of the Eisenhower Matrix

John categorized these tasks into the four quadrants of the Eisenhower Matrix as follows:

- Quadrant 1 (Important and Urgent): Addressing immediate bugs in the trading platform. These were critical for the startup’s operations and had an immediate deadline.

- Quadrant 2 (Important but Not Urgent): Strategic planning for the next funding round. These tasks were vital for the startup’s long-term success but could wait.

- Quadrant 3 (Not Important but Urgent): Responding to non-urgent emails and meeting requests. These tasks were urgent but not critical to the startup’s success.

- Quadrant 4 (Not Important and Not Urgent): Social media updates, which were delegated to the marketing team.

The Outcome

By adhering to these priorities, John was able to secure a new round of funding while ensuring the platform’s reliability. He also managed to delegate tasks effectively, freeing up his time for more strategic work.

Lessons Learned

John’s experience is not unique. A case study by Hackquarters highlights how startups can benefit from the Eisenhower Matrix. It emphasizes the importance of categorizing tasks into the four quadrants to manage time more efficiently. The study also discusses potential pitfalls and offers solutions to help navigate them effectively.

Challenges and Solutions

One of the challenges John faced was differentiating between urgent and important tasks. This is a common issue, as highlighted in the same Hackquarters article. The solution is to reflect on what truly matters for the startup’s success. Long-term goals should guide the categorization of tasks in the matrix.

By applying the Eisenhower Matrix, John was able to focus on what truly mattered for his startup’s success. He noticed a significant improvement in his productivity and felt less overwhelmed.

Additional Insights

According to a Forbes article, the Eisenhower Matrix is not just a tool for individual productivity; it can be scaled to an organizational level. It can be integrated into project management software or used in team meetings to collectively decide on priorities. This ensures that everyone, from top-level executives to entry-level analysts, is aligned in their focus and efforts.

For a more in-depth understanding, you can refer to this Corporate Finance Institute article, which provides a detailed breakdown of the Eisenhower Matrix and its applications.

Practical Tips for Implementing the Eisenhower Matrix in the Financial Industry

Start Early

The early bird catches the worm, as they say. Begin your day by laying out your tasks and categorizing them into the four quadrants of the Eisenhower Matrix. This exercise will give you a clear roadmap for the day, allowing you to allocate your time and resources more effectively. According to a study by the Dominican University of California, individuals who write down their goals are 33% more successful in achieving them compared to those who merely think about them.

Delegate Effectively

In the financial industry, where time is often equated with money, effective delegation is crucial. Tasks that fall into Quadrants 3 and 4 (Not Important but Urgent, and Not Important and Not Urgent) should be delegated whenever possible. This frees up your time to focus on tasks that are both important and urgent. A Harvard Business Review article emphasizes the importance of delegation and provides insights on how to do it effectively.

Review and Adjust

The financial landscape is ever-changing and influenced by market trends, regulatory changes, and technological advancements. Therefore, it’s essential to review your tasks and priorities at the end of the day or week. Take note of what you’ve accomplished and what needs to be shifted to a different quadrant. An article by Inc suggests that mindfulness techniques can help in this review process, enabling you to adjust your priorities with a clear mind.

By incorporating these practical tips into your daily routine, you’ll be better equipped to navigate the complexities of the financial industry. The Eisenhower Matrix serves as a robust framework for decision-making, helping you to focus on tasks that align with your professional goals and the strategic objectives of your organization.

Key Takeaways and Conclusion: Elevate Your Decision-Making

In summary, the Eisenhower Matrix is not just a tool for managing your time; it’s a strategic framework for elevating your decision-making process, especially in the fast-paced, ever-evolving financial industry.

Be Proactive, Not Reactive

The Eisenhower Matrix empowers you to be proactive in your approach. It helps you plan your actions in advance, allowing you to anticipate challenges and opportunities rather than merely reacting to them.

Delegate Wisely

The matrix teaches you the art of delegation. It helps you identify tasks that may be urgent but not necessarily important for you to handle. By learning to delegate these tasks effectively, you free up time and mental space for strategic thinking and high-impact activities.

Focus on Long-Term Goals

One of the most significant benefits of the Eisenhower Matrix is its ability to help you focus on long-term goals. It encourages you to allocate time for tasks that are important but not urgent, which are often the tasks that align with your long-term objectives.

A Structured Approach to Success

Time management is not just about filling your day with tasks; it’s about filling your day with meaningful actions that drive you toward your goals. The Eisenhower Matrix provides a structured way to approach your tasks, helping you make better decisions and ultimately become more successful in your role.

For those looking to delve deeper into time management and decision-making, I highly recommend the book “Eat That Frog!” by Brian Tracy. This book offers advanced time-management techniques tailored for executives and is available on Amazon.

By adopting the Eisenhower Matrix in your daily routine, you’re not just managing time; you’re managing your career, your team, and your company’s future. It’s a tool that every financial executive should consider integrating into their strategic planning and daily operations.

0 Comments